Owning a car is one of the most important goals that the typical Filipino aims to achieve. Because cars tend to be costly investments, many people may look for ways to reduce their expenses and forego insurance to do so. Cubao residents shouldn’t compromise their financial security by not getting insured since vehicular accidents are commonplace in Metro Manila, and the resulting damages can damage people’s finances.

Many Filipino car owners aren’t insured, and one reason for this is because they want to cut their expenses. Filipinos are also superstitious, and getting insured can mean inviting trouble to come, resulting in car accidents. They fail to realize that there are many irresponsible drivers on Metro Manila’s roads, and these same drivers are usually uninsured. An auto accident victim will only be able to pay out of their pockets to cover the associated costs of a crash or a collision.

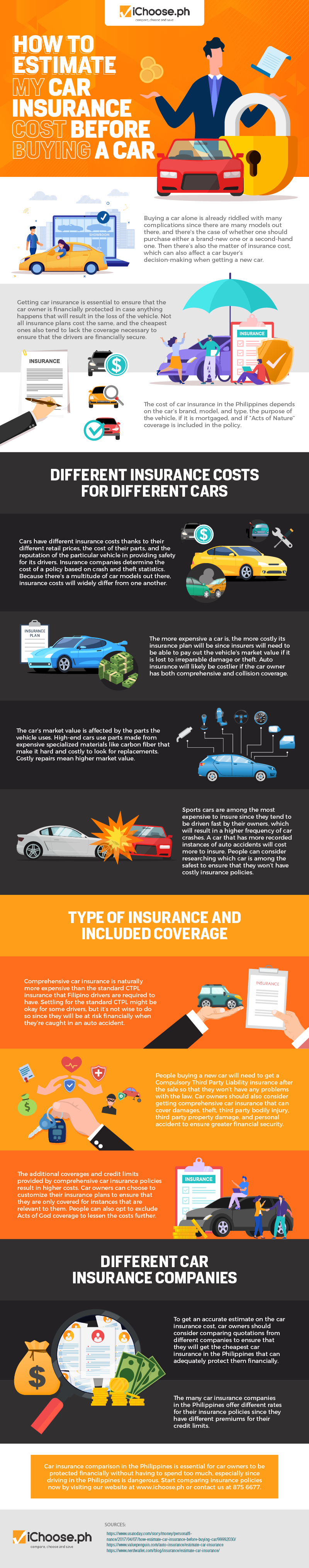

Car insurance isn’t necessarily expensive, and people can estimate how much the insurance plan will cost even before they purchase a car. Cubao residents can get affordable car insurance Cubao to protect drivers from the high costs of vehicular accidents. It’s essential to acquire both an affordable compulsory third party liability insurance and a comprehensive insurance plan, and car owners can have them by comparing insurance plans.

One way to estimate the insurance plan’s price is through the car’s model. Expensive car models will have costly insurance policies since insurers must be able to pay out the vehicle’s market value. Cars with high market value have expensive spare parts, resulting in higher insurance costs. The particular model’s reputation among other drivers can also affect the insurance’s price.

The type of insurance plan also affects the insurance cost due to the number of inclusions in the coverage. The basic CTPL plan is significantly cheaper than comprehensive insurance plans due to their limited insurance coverage. CTPL only covers third party liability while comprehensive car insurance plans cover more, including third party liability, third party property damage, own damage, and personal accident. Comprehensive insurance plans are even costlier when people get Acts of God coverage to protect their cars from another Ondoy.

Car owners can also estimate how much they’ll have to pay for insurance by comparing insurance companies’ policies. Different insurers offer different plans with varying costs. By comparing insurance plans, car owners can get insured without having to spend too much.

Insurance is necessary to protect car owners from financial ruin. For more information, see this infographic by iChoose.ph.